Ups & Downs

- Wide selection of trading tools and features

- Institutional grade spreads via the Raw ECN account

- Linked to the top platforms in the industry: MetaTrader 4 and MetaTrader 5

- High minimum deposit of $200, even on the Standard STP account

- Strict terms and conditions on the Welcome Bonus offer that prevents withdrawal

Overview

VTmarkets

VT Markets is an Australian-based trading broker with clients in over 160 countries. Over 1000 instruments are available with zero-pip spreads, ultra-fast execution speeds, joining deposit bonuses, and 24/5 customer support in multiple languages. In this 2023 review, we help you discover if VT Markets is right for you, with details on available assets, minimum deposits, withdrawals, MT4 platform downloads, leverage and more.

Company Details

VT Markets PTY Ltd is a multi-asset broker that promises to be a one-stop shop for all trading needs. It is based in Sydney, Australia, but has a global presence with clients in the EU, UK, Canada, and Asian jurisdictions, such as Singapore and Thailand. VT Markets now has over 70,000 clients on their books and has recently opened a new office in Malaysia that will offer regional support to customers and affiliates.

The firm was founded in 2015. The Managing Director and CEO is Chris Nelson-Smith. VT Markets is also regulated by well-regarded global authorities: ASIC in Australia and FSCA in South Africa. In addition, the brokerage is registered with the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA).

VT Markets aims to put innovation at the forefront of its services, helping modern traders capitalize on market opportunities in their daily lives. The broker caters to traders looking for fast execution speeds, reliable customer support, user-friendly platforms, plus fast deposits and withdrawals.

New users can get started with a $200 minimum deposit.

Trading Platforms

VT Markets prides itself on its technological capabilities. Therefore, it’s no surprise to see it offers the most popular trading platforms on the market: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Plus, VT Markets boasts the oneZero™ MT4 Bridge, which enables low latency and fast execution across multiple asset classes at all times of the day.

MetaTrader 4

Our experts found the platform offers:

- 9 timeframes

- 2 market orders

- 4 pending orders

- Interactive charts

- 3 execution modes

- 23 analytical objects

- 30 technical indicators

- 2 stop orders and a trailing stop

- Plus, the MT4 Market offers access to a further 1,700+ trading robots and 2,100+ technical indicators

- Wide selection of trading tools and features

- Institutional grade spreads via the Raw ECN account

- Linked to the top platforms in the industry: MetaTrader 4 and MetaTrader 5

- High minimum deposit of $200, even on the Standard STP account

- Strict terms and conditions on the Welcome Bonus offer that prevents withdrawal

MetaTrader 5

MT5 builds on this, offering a wider selection of built-in tools and functionality:

- 21 timeframes

- 80 technical indicators and analytical tools

- Allows opening up to 100 charts of currency and stock quotes at a time

VT Markets offers free downloads of MT4 and MT5 directly from their website. Just sign up for an account with the broker, download the software and log in using the credentials provided by VT Markets.

Note, a web trader solution is also available through the broker’s website.

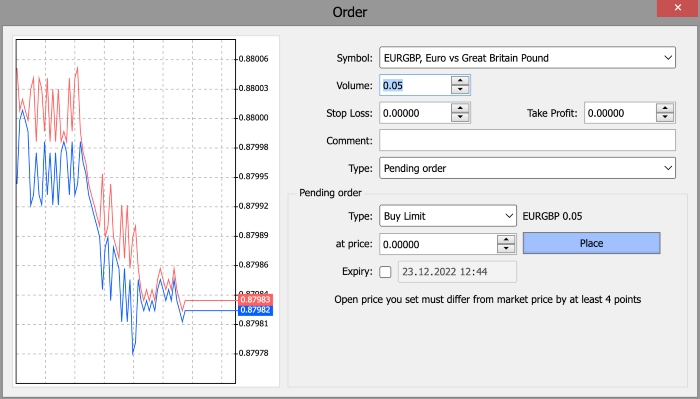

How To Make A Trade

To enter a new trade on the MetaTrader platforms:

- Select the New Order icon (white page in the top menu bar)

- Choose an asset from the drop down list

- Enter the volume

- Input any stop loss and take profit levels

- Add any trade comments

- Choose between instant execution and pending order

- Confirm the trade

Assets & Markets

VT Markets provides an impressive selection of 1000+ assets:

- Forex – 40+ currency pairs, available for trading 24/7 during weekdays, leverage up to 1:500 depending on your jurisdiction, experience and the asset volatility

- Indices – 15+ world stock exchange indices, including S&P 500, DAX30, and FTSE 100

- Energy – Spot energy contracts against the US dollar on Crude Oil (Cash/Future), Natural Gases, Gasoline and Gasoil

- Precious Metals – Gold, silver and copper contracts against the US Dollar and Euro

- Soft Commodities – Cocoa, coffee, cotton, orange juice and raw sugar contracts

- US CFD shares – 500+ US blue-chip stocks starting at just $6 per trade, long and short positions available, 1:20 leverage

- HK CFD shares – 50+ companies listed on the Hong Kong Stock Exchange, starting at just 50HKD per trade

- EU CFD shares – 140+ European shares with low fees on the MT5 platform

- UK CFD shares – 100+ equities listed on the LSE, 1:20 leverage

VT Markets also offers bond CFDs and ETFs.

Spreads & Commission

When trading with VT Markets, spreads are charged on forex, commodities and indices. The spread is the difference between the buy and sell price of an asset. It is essentially the mark up that a broker makes when selling to you. All spreads are live and vary by account type, with ultra-tight zero-pip spreads available.

The ECN Raw account offers some of the lowest spreads in the industry. Prices are sourced directly from large liquidity providers, meaning clients receive the same prices as institutional traders. Spreads start at 0.0 pips with this account. On the Standard STP account, spreads start at 1.2 pips for the EUR/USD, 1.8 pips on GBP/USD and 1.6 pips on AUD/USD. To view the live spreads per asset, visit the MetaTrader platform and click ‘Market Watch’ then ‘Spreads’.

On the ECN account, there are also commission charges. These are priced differently depending on the trading account currency. For USD this is $0.03 (round turn $0.06) per 0.01 lots (1,000 base currency). For AUD this is AUD $0.03 (round turn $0.06) and GBP £0.02 (round turn £0.04).

VT Markes Leverage

VT Markets allows traders to utilize leverage on both forex and CFD contracts. This means clients can open positions that are larger than their original deposit. Leverage multiplies the results of a trade, so a position opened with a 1:20 leverage could make 20x the profits that the deposit would have. However, this also comes with risk since losses are amplified too. Therefore, traders should consider their risk appetite before making a leveraged trade.

VT Markets offer leverage up to 1:500 depending on the asset traded. This limit is available by application only via your Client Portal. In most jurisdictions, leverage limits apply due to the measures imposed by the regulatory authorities. Therefore, to reach these high leverage allowances, you may have to prove that you are operating as a professional trader.

Mobile App Review

VT Markets offers MetaTrader 4 and MetaTrader 5 on mobile apps. MT4 and MT5 are available for download on iOS and Android. These enable traders to operate while on the go, viewing their portfolio’s progress and executing trades at any time of day.

The mobile apps offer a similar level of functionality as the desktop solutions, however, most traders prefer to complete detailed analysis on the desktop, as the larger screen size makes operating easier.

VT Markets also offers its own proprietary mobile app. It provides access to 230+ trading instruments, in-depth financial analysis and smart risk-management. One-click trading and customizable watchlists can also be set up.

Deposits & Withdrawals

To deposit funds with VT Markets, visit the Client Portal upon registration, click ‘Funds’ and ‘Deposit’. Select from the payment methods available to begin the transaction.

Both wire transfer and credit/debit card deposits are available. Plus, there is the option to deposit with e-wallets like AliPay, Skrill and UnionPay. Deposits usually arrive in your account within 60 minutes of a successful transaction. If funds are not showing as expected, VT Markets advises you to contact deposit@vtmarkets.com with your transaction receipt, trading account number and the payment ID. The customer service team will investigate the issue and aim to resolve it as soon as possible.

The minimum deposit amount is 200 units of the base currency. This is a fairly high threshold to achieve, particularly for traders that are new to the platform. There are brokers in the industry that offer much lower minimum deposits, or none at all.

When withdrawing funds from VT Markets, first your payment details will need to be verified. Visit the Client Portal, ‘Funds’, then ‘Withdraw Funds’. Here you will be able to view your balance minus any bonus credits.

Credit/debit cards and bank wire transfers take 3-7 days to process. Other payment methods can be much quicker. E-wallets and USDT withdrawals take 1-3 working days.

Demo Account

VT Markets offers a demo account for all traders.

To open one, visit the website and input your details. In just five steps, you’ll be ready to start practising. You’ll have the option to configure your account by selecting the platform, account type (which will impact the prices offered), base currency, leverage and account deposit amount. You’ll immediately be provided with the login details required to get started. Just visit the MT4 platform to start trading.

Your demo account account will be live for 90 days.

Promotions & Bonuses

New VT Markets clients can opt-in to a 50% welcome bonus up to $500. If your first deposit exceeds $1000, you’ll receive an additional 20% bonus for everything beyond that value up to a credit value of $10,000.

However, be sure to read the terms and conditions. Credit cannot be withdrawn, and losses will come from your account balance, not the credit amount. Therefore, the bonus may not be beneficial to your bottom line.

VT Markets also offers a string of other deals for new and existing users. This includes a 7 day loss recovery feature for new account holders, free trading signals, and cashback for active traders. Clients can opt in or out of deals by heading to the ‘Promotions’ tab within the Client Portal.

Regulation & License

VT Markets is regulated by some of the top global authorities. In Australia, the firm is licensed with the Australian Securities and Investments Commission (ASIC). Australian clients will benefit from the security this provides, including negative balance protection and segregated client funds.

The firm is also regulated by the Financial Sector Conduct Authority (FSCA) in South Africa and registered with the Saint Vincent and the Grenadines Financial

Services Authority (SVGFSA).

Additional Features

VT Markets provides an excellent range of additional services through some of the industry’s best third-party software providers:

- Forex Signals – Available from leading signal providers, MetaQuotes, Trading Central and Acceage, many of which are free of charge.

- Expert Advisors – There are no restrictions on automated trading on VT Markets. A selection of EAs are available from the MT4 code base, or you can write your own using MetaEditor.

- Market Analysis – Daily market focus blogs covering all major assets provided on the VT Markets website.

- Forex Education – For new traders, the VT Markets forex 101 guides cover the basics.

- Forex Calculator – Fibonacci and pivot calculators, currency converters and Stop Loss/Take Profit levels.

- Economic Calendar – Useful information on world calendar events.

- MAM/PAMM Accounts – Multi account manager (MAM) and per cent allocation management module (PAMM) service options available to all traders.

- Social Trading via ZuluTrade – Social trading functionality that enables clients to locate successful traders by their ZuluRank, follow their portfolios and copy their trades. Plus ZuluGuard means appropriate risk management techniques can be implemented.

- Trading Central ProTrader Tools – For clients with a minimum of $1,000 in their account, ProTrader Tools provides trade set-up ideas, technical analysis on over 80,000 assets and next-generation AI market news.

Account Types

When we used VT Markets, we found the broker offers three live accounts:

Standard STP Account

- Lightning-fast execution speeds on the Equinix Fibre Optic Network

- Accounts available in AUD, USD, GBP, EUR, CAD

- Minimum order size of 0.01 lot

- $0 commission on all tradeable assets

- Spreads starting at 1.2 pips

Raw ECN Account

- Institutional grade liquidity

- Lowest spreads in the industry, starting from 0 pips

- Commission is charged at $6 (per round turn)

- AUD, USD, GBP, EUR, CAD base currencies

Islamic

- Swap-free trades designed for Muslim traders

- Available with both STP and ECN specification

How To Open A Live Account

Follow the ‘Visit’ link at the top or bottom of this review. Next, click on ‘Open A Live Account’. Enter basic contact information, including your name, email address, phone number, and country. Then follow the on-screen instructions and verify your account using the link provided.

It takes less than 5 minutes to open a live account.

Benefits Of VT Markets

While using VT Markets, our traders highlighted several key advantages:

- 1000+ instruments

- Welcome deposit bonus

- Proprietary trading app

- Lightning fast execution speeds

- Fast account deposits and withdrawals

- 24/5 customer support in multiple languages

- Institutional grade spreads via the Raw ECN account (starting from 0.0 pips)

- Linked to the top user-friendly platforms in the industry: MetaTrader 4 and MetaTrader 5

- Cryptocurrency withdrawals (USDT)

- Social trading

Drawbacks Of VT Markets

- No cryptocurrency trading

- Strict terms and conditions on the welcome bonus offer that prevents withdrawal

- EU-based clients should be aware VT Markets is not regulated by a European authority

Trading Hours

VT Markets is available for trading 24 hours a day. With over 40 currency pairs, there will be a market open at all times of day. However, you will want to look out for the most liquid times for the best spreads.

- USD/GBP – 12:00 – 16:00 GMT

- AUD/JPY – 6:00 – 8:00 GMT

- GBP/JPY – 7:00 – 9:00 GMT

Customer Support

VT Markets has a help centre on the website that will enable you to self-serve any answers to questions. This should be your first port of call for any queries. For more complex questions, try the live chat function.

24/5 customer support is also available in multiple languages. VT Markets provides a contact email address: info@vtmarkets.com. For urgent queries, request a callback by visiting ‘Contact Us’ on the website.

The broker has a presence on social media on both LinkedIn and Facebook, however, the pages are not responsive for customer service queries.

Safety & Security

VT Markets promises the following with regards to the safety of your personal information and funds:

- Segregated Funds – As a regulated broker, VT Markets is required to keep customer funds segregated from that of the business. In the event of liquidation, your funds will be secure. The money is held in Australia’s AA rated Commonwealth Bank of Australia (CBA).

- SSL Encryption – Registration and all electronic payments are processed through the Secure Sockets Layer, meaning they’re encrypted at all points during the transaction.

VT Markets Verdict

VT Markets is a great choice for traders looking for tight spreads combined with strong technological capabilities. With fast execution speeds and unrivalled access to some of the top third-party software, including MT4 and MT5, ZuluTrade, and Trading Central, VT Markets has combined the best of the industry to deliver an all-in-one service to it clients.

Accepted Countries

VT Markets accepts traders from Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use VT Markets from United States, Korea.

FAQ

Is VT Markets A Legitimate Broker?

VT Markets is a legitimate online trading broker that is regulated by the Australian Securities and Investment Commission (ASIC) and the FSCA in South Africa. This can provide Australian traders with a significant level of trust since the Commission aims to protect retail traders from undue risk.

Is VT Markets Regulated?

Yes, VT Markets is regulated by the Australian Securities and Investment Commission (ASIC). They are also regulated by the FSCA in South Africa.

For clients from the rest of the globe, the firm is registered with the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). This regulator is less stringent than ASIC and European authorities, so traders should implement their own risk management strategies.

Does VT Markets Provide Swap-Free Accounts?

Yes, VT Markets offers swap-free Islamic accounts on both their Standard STP and Raw ECN options. Muslim traders can receive all the same benefits as the standard accounts, including tight spreads and no commission, all with the additional benefit of being swap-free.

What Trading Platforms Does VT Markets Provide?

VT Markets provides the well-regarded MetaTrader 4 and MetaTrader 5 platforms. These forex titans are hailed for their customization and wide range of analytical tools.

Does VT Markets Provide A Welcome Bonus?

Yes, new VT Markets clients can benefit from a 50% welcome bonus up to a value of $500. For deposits beyond the $1000 mark, clients will receive an additional 20% bonus.

However, make sure to read the terms and conditions. It is not possible to withdraw credit funds and losses will be taken from the account balance.