- Fast and Reliable Payments

- Unlimited trial

- Lowest spread offered with a very low commission

- Extremely well-regulated

- Good copy trading proprietary platform

- The broker may close your account after 30 days of inactivity

- EU clients have a different minimum deposit

- Services may differ depending on your area

- No social trading feature

Sở hữu rất nhiều giấy phép từ các tổ chức uy tín5

Overview

-

Fast Deposits & Withdrawals:FCA, CySEC, DFSA, FSCA, SFSA, BaFin

HFM

- Fast and Reliable Payments

- Unlimited trial

- Lowest spread offered with a very low commission

- Extremely well-regulated

- Good copy trading proprietary platform

HFM is the new name for the HotForex trading platform. This broker has been known to Vietnamese traders since 2011-2012. At that time, the platform organized many grand seminars at 5-star hotels in Ho Chi Minh City and Hanoi. HFM is particularly famous for its PAMM/MAM trade copy platform, which has a large user base.

Introduce

Website: HFM.com

Part of the HFMarkets Group, the HFM exchange (formerly known as Hotforex) was established in 2010 with its headquarters located in Larnaca, Republic of Cyprus. Currently, the main office of the exchange is located in the nation of St. Vincent and the Grenadines. HFM’s operating philosophy is: “Not just a mission, it’s a promise.” The company positions itself with the following mission statement: “Our mission is to provide the Best Customer Service to our Clients by maintaining a culture of putting the Client at the center of everything we do. In this way, we will achieve our vision of maintaining our position as a Market Leader renowned for providing Excellent Customer Service.”

After more than 10 years, HFM has built a brand and a significant customer base. Over 2.5 million customer accounts have been opened and served by 200 employees worldwide.

With a wide range of operations, HFM’s forex platform is protected by legal entities from many different regions.

The operating licenses that HFM has been granted

HIS FCA LICENSE HAS BEEN GIVEN TO HFM

FCA (Financial Conduct Authority) is the financial services regulatory body in the UK. It operates under the UK Treasury and Parliament. FCA is a highly respected and strict regulatory body in the Forex industry worldwide.

Under FCA regulations, Forex brokers must adhere to all strict rules.

Brokers must keep client funds separate from their own capital accounts.

Brokers must be members of the UK compensation scheme.

Brokers must maintain a minimum of 1 million pounds sterling in operating capital.

HFM has been granted an FCA license on November 14th, 2018, with registration number 801701, under the name HF Markets (UK) Limited. This license allows the company to operate as a forex trading platform using the Straight Through Processing (STP) protocol. Prices are processed directly through the platform’s servers to liquidity providers, without any interference or dealing desk

CYSEC LICENSE IS GUARANTEED TO HFM

CySEC (Cyprus Securities and Exchange Commission) is the Securities and Exchange Commission of Cyprus, a European Union member country. Therefore, CySEC adheres to the European Union’s MiFID financial balance law.

CySEC requires a minimum capital of 730,000 euros, a physical office presence in Cyprus, and three senior local staff. All senior directors must have strong and specialized financial experience. The broker must hold investors’ funds in separate accounts at European banks.

Along with FCA, CySEC is a reputable and tightly regulated Forex industry regulator.

HFM was licensed by CySEC on November 20, 2012, under the name HF Markets (Europe) Ltd, with registration number 183/12.

DFSA LICENSE OF DUBAI

DFSA (The Dubai Financial Services Authority) is the financial services regulator in Dubai. Established in 2004, it operates as the central financial authority in the special economic zone of the Dubai International Financial Centre. The DFSA is separate and distinct from the federal regulators of the United Arab Emirates.

HFM is licensed by the DFSA on December 12th, 2018 with registration number F004885, under the name of HF Markets (DIFC) Limited.

Spain’s CNMV LICENSE

CNMV (Comisión Nacional del Mercado de Valores) is the National Securities Market Commission of Spain. It is a government agency responsible for regulating and overseeing the securities market and financial management within the country. The agency operates within the legal framework that meets the criteria of the EU.

CNMV plays a crucial role in ensuring the smooth functioning of the foreign exchange market in Spain. Forex companies are not allowed to advertise falsely or cause any misunderstandings.

HFM was licensed by CNMV on April 3, 2013, with registration number 3427, under the name HF MARKETS (EUROPE) LTD.

OTHER LICENSE OF FOREX HFM

In addition, HFM also holds licenses for foreign exchange operations in countries such as St. Vincent & the Grenadines, Seychelles, and South Africa, under corresponding names HF Markets (SV) Ltd, HF Markets (Seychelles) Ltd, and HF Markets SA (PTY) Ltd.

The popularity of the HFM brand in the world

According to Alexa’s ranking, HFM is currently ranked 20138 among billions of websites globally. This ranking is not high compared to the overall level of forex exchanges. The website is most accessed from Nigeria, where it holds a position of 692.

According to Google Trends, the popularity of HFM has remained relatively stable over the past five years

The awards of forex broker HFM

HFM is also a forex trading platform that has a considerable collection of awards over the years. After more than 10 years of operation, HFM has gradually established its reputation in the forex market. Here are some of the awards that this broker has achieved:

Best Forex Trading Platform in Asia 2021 awarded by Global Business Magazine.

AWARD FOR BEST CLIENT FUND SECURITY GLOBAL 2021, as voted by International Business Magazine.

Top 100 companies as voted by World Finance Magazine.

In addition, HFM Exchange has also received over 50 awards and 40 titles for having the best customer service and being the most trusted exchange for many years.

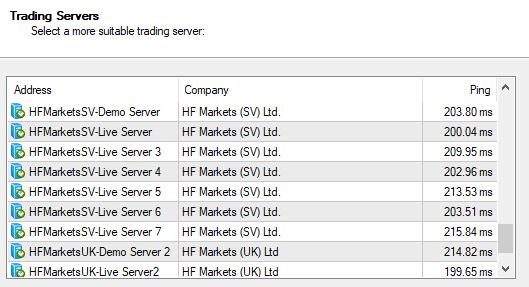

HFM Exchange has a diverse range of servers

HFM Exchange invests heavily in the number of servers located in various countries around the world in order to provide the best service to its large customer base. Currently, HFM Exchange has 30 servers located in countries such as the UK, Dubai, Seychelles, and South Africa, among others.

Is HFM platform a scam?

Besides its long-standing presence, HFM platform also holds licenses from reputable financial agencies such as FCA and CySEC. Therefore, HFM is definitely not a fraudulent forex platform. You don’t need to worry about depositing money and not being able to withdraw it. Moreover, the 5 million Euro insurance fund in case HFM becomes insolvent is currently the largest insurance fund among forex platforms worldwide. When trading with HFM, you can completely trust its reputation as well as the safety of your deposited funds.

Financial safety for customers

HFM’s compensation insurance fund

HFM is the only forex platform awarded with the title of Best Client Fund Security Global 2021. This demonstrates that HFM highly values the safety of its customers’ deposited funds.

Segregated account

HFM Exchange only utilizes large global banks and maintains separate client accounts. The international prestige and strength of the HFM brand allows the company to provide liquidity through major banks.

Customer funds are received into separate bank accounts that are segregated from the company’s own accounts. These funds are kept separate from the balance sheet and can be used to pay creditors in the rare event that the company becomes unable to pay.

Renaissance Insurance Brokers provides insurance coverage.

As a licensed entity by reputable financial regulators around the world, HFM is required to maintain a reserve of £1 million for FCA license and €730,000 for CySEC license. In case of risk, customers are compensated up to £50,000 under FCA license and €20,000 under CySEC license.

In addition, HFM guarantees its responsibility to customers and third parties through a 5 million euro Public Liability insurance program from Renaissance Insurance Brokers. This includes market-leading coverage for errors, omissions, negligence, fraud, and many other risks that may lead to financial loss.

Negative account protection policy for customers opening accounts at HFM

According to the announcement on HFM’s official website, customers’ accounts are protected from negative balances.

Due to the large leverage and fast movement of the market, you may lose more than your initial investment. Normally, you have to compensate for that loss. However, at HFM, you are protected from this loss. This is a significant advantage for account allocation and optimizing trading leverage.

Independent Audit Firm

HFM uses a third-party audit firm to publicly disclose its financials and ensure transparency of all documentation. The service that HFM uses is Deloitte, a reputable, long-standing audit company. Independent auditing is a requirement from CySEC. This agency obligates forex exchanges to regularly submit financial reports to review compliance with the exchange regulations.

Types of HFM accounts.

>>

Instructions for opening a trading account at HFM

HFM provides a wide range of account types, which creates comfortable choices for many customers. However, it can also cause confusion for some new customers. Fx24.net will help you choose the most suitable account type. Currently, HFM offers six account types as shown in the image below:

MICRO Account

In the MICRO account, your funds will be denominated in cents. The displayed amount will be multiplied by 100 times the amount you deposited. For example, when you deposit $10, you will have $1000 (cents) for trading. This account type is suitable for beginners in the market. Especially, traders using martingale robots can use this account type to facilitate lot sizing.

PREMIUM Account

This is a type of account designed by the HFM exchange for experienced traders. The minimum deposit amount is $100, higher than the $5 minimum for Micro accounts. However, in exchange, you can enjoy relatively low bid-ask spreads, starting from just 1 pip. This account type does not charge commission fees.

ZERO SPREAD account translation:

This type of account from HFM is preferred and highly rated by most traders. As the name suggests, this account has a buy-sell spread of 0. This is a raw spread provided by liquidity providers and has not been marked up by the broker with additional costs. However, traders will incur a commission fee of $6/lot.

The Zero Spread account is suitable for professional traders who trade with large lot sizes, engage in short-term scalping or use trading robots.

AUTO account

HFM designed this type of account for novice traders or traders who are experiencing losses and want to copy profitable trading signals from MQL5. The buy and sell signals will be automatically integrated into the MT4 software by HFM. Traders only need to open an account and follow HFM’s simple instructions.

For Auto accounts, you will incur monthly fees if you choose to follow paid signals.

HFM PAMM account

PAMM (Percent Allocation Management Module) is an account type for traders to manage funds. This account is funded by clients, and the trader managing the account will trade this amount along with their personal capital. Profits or losses are divided according to the ratio set by the fund manager in advance with the client.

PAMM is a very popular investment model of HFM. This type of account attracts a large number of traders to participate.

There are 2 types of PAMM accounts for traders (fund managers, traders) with experience and investors (without experience or who want to copy signals).

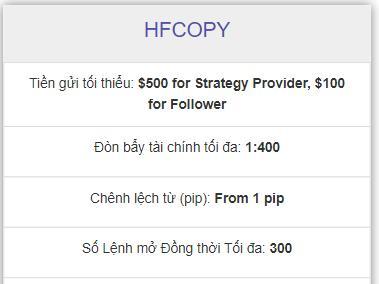

HFCOPY account

This type of account is also designed for fund managers and investors. This account is similar to PAMM, but with some differences such as: the ability to withdraw funds at any time, only displaying profits or losses when positions are closed; investors can set their own risk tolerance, and they can intervene in the trading account, such as cutting running orders.

MT4 and MT5 trading software

So which type of account should you choose among the account types offered by HFM?

- HFM offers 6 types of accounts, but 3 of them involve copying signals from other traders.

- If you are a complete beginner and want to trade on your own, you should choose the Micro account.

- If you trade using a Martingale-style trading robot, then the Micro account is the most suitable option.

- If you are an experienced trader, you can choose the Premium or Zero Spread account. If you open an account over $200, it is recommended to prioritize the Zero Spread account as it has lower total trading fees.

- If you are a new trader or losing money and want to fully entrust your account to an experienced trader, then the PAMM account is the best option. Be sure to carefully review the strategy and performance of top traders, including both profits and risks, to make an informed choice.

- If you come across any good signals while browsing mql5.com and want to copy them, choose the Auto account.

- Investors who want to copy signals but still want to actively manage their accounts should choose the HFCOPY account, which is the optimal choice.

Software at forex broker HFM

HFM provides both MT4 and MT5 trading platforms, offering a range of options suitable for different specific devices such as Windows and Mac OS computers, Webtrader, MT4 and MT5 software compatible with iOs, as well as Android.

MT5 is not available for Auto, PAMM, and HFCopy account types.

HFM also offers Multiterminal trading software, which allows traders to manage multiple accounts simultaneously.

In addition, HFM provides Rapid Trader FIX/API technology. With this technology, clients do not need to trade through HFM’s trading software. Clients can trade on other software platforms with their own customized interface connected through this technology. With a minimum deposit of $200,000, this platform is suitable for brokers, hedge funds, and money managers with large capital.

HFM Copy Trading Platform

- Instructions on how to copy orders at HFM

- Although HFM does not provide a Copy Trade platform as commonly seen nowadays, it offers a more diverse range of copy trading options. HFM is a unique name when it comes to providing copy trading technology from MQL5, active copy trading like Hfcopy (similar to Copy Trade), and PAMM funds.

- HFM offers three types of accounts as well as three types of platforms for investors to choose from, from basic to advanced levels.

- For the AUTO account, which copies signals from MQL5, customers need to deposit at least $200. For the Hfcopy account, which is active copy trading, followers only need to deposit a minimum of $100.

- Of the three copy trading account types, PAMM funds are the most heavily developed by HFM. There are over 100 profitable PAMM funds for investors to choose from, including many accounts that have been trading for over 2000 days. This is an attractive account type for new investors and traders. All you need to do is create a PAMM account, filter out traders with stable and safe profit ratios from the list, and the system will then copy the trades of these professional traders into your account. If they win, you win, and vice versa.

Order matching speed at HFM

- HFM is a trading platform with a massive number of servers distributed widely. In addition, the market order matching mechanism ensures that customer orders are executed smoothly and efficiently.

- However, due to the non-quote reporting mechanism, price slippage is common during market fluctuations.

- There are several utility tools available on the HFM platform.

AUTOCHARTIST TOOLS

- Identify three types of patterns: Chart patterns, Fibonacci patterns, and Key Level patterns. All of these are based on support and resistance levels.

- This feature saves time and improves trading efficiency for traders because the automatic scanning tool can identify tradable patterns.

- The search function and multiple filters allow users to create custom watchlists.

- It can be installed directly onto MT4 or MT5 software.

- In summary, this is an excellent feature that helps you quickly identify price patterns. However, the tool is only free for accounts with a balance of $500 or more.

EXCLUSIVE ANALYSIS FROM HFM

- Every day, HFM customers receive exclusive analysis from 20-year experienced expert Stuart Cowell. However, the content is only available in English and does not support Vietnamese language. You can use Google Translate to get a general understanding.

- In addition, HFM provides many other premium trading tools such as Market Sentiment Indicators, Trading Sessions, and Correlation Charts.

FREE VPS

- HFM’s VPS provider is Beeks Financial Cloud with 9 international data centers, ensuring lightning-fast response times. Beeks focuses on providing low-latency, robust VPS solutions and infrastructure for its traders with an accessible trading platform.

- HFM’s VPS packages are provided for free, but this depends on specific deposit and trading requirements. For the lowest VPS package, you need a minimum balance of $5,000.

- Products and leverage offered on the HFM exchange.

Trading Products

- HFM currently offers its customers more than 1200 trading products, including:

- Forex: 53 pairs, including 15 major pairs and 38 cross pairs, including rare pairs such as RUB, MXN, ZAR, THB…

- Precious metals: There are 4 types including Gold, Silver, Platinum and Palladium. Among them, Gold and Silver have USD and EUR as the base currency.

- Energy: Includes crude oil and Brent oil for spot and futures contracts.

- Stocks: There are 54 codes, which are popular stocks listed on NYSE, NASDAQ, LSE, EURNEXT…

- Indices: There are 11 spot contract codes such as AUS200, USA500.s, UK100,… and 12 futures contract codes such as EU50.F, US500.F, US30.F,…

- Bonds: There are 3 types from Europe, UK, US: EUBUND.F, UKGILT.F and US10YR.F

- Commodities: 5 types including cocoa, copper, cotton, coffee, sugar.

- In addition, HotForex has recently launched two new products, including DMA Stocks and ETF Funds.

- DMA Stocks: DMA stands for Direct Market Access, where customers receive trading prices and order matching directly from the underlying stock market. There are 946 stocks from countries such as the Netherlands, France, the UK, the US (NYSE, NASDAQ), Germany, Ireland, and Spain.

- ETF Funds: There are 34 ETF codes from various industries. In particular, the GLD code from the SPDR Gold Trust fund is very familiar to gold investors.

- With the extensive product list listed above, both new and seasoned investors can trade. Especially for stock enthusiasts, HotForex is a platform not to be missed.

Financial leverage

- Leverage on the HFM exchange is not uniform but diversified across different industry groups.

- The HFM exchange offers a maximum leverage of 1:1000 for forex products. The leverage for gold and indices is set at a maximum of 1:200, while for silver, it is set at a maximum of 1:100. Precious metals such as platinum have a floating leverage, while palladium has a maximum leverage of 1:20.

- The leverage for stocks provided by HotForex is 1:14.

- A leverage of 1:5 is applied to DMA stocks and ETF funds.

Trading fees on the HFM exchange

When choosing an exchange, trading fees are an essential factor that traders cannot overlook. At HFM, trading fees are distributed differently across various product types. This can be confusing for new investors. However, Fx24.net will help you streamline and condense the information as much as possible. From there, you can make the most accurate decision.

– Spread:

The lowest fee for spread belongs to the Zero Spread account type. The EURUSD product has the lowest spread from 0 pip and an average spread of 0.1 pip. The corresponding spread for ECN accounts at some other brokers.

In other account types, the spread is always displayed from 1 pip and above.

- Commission fee:

HFM forex broker does not charge commission fees on all account types except for the Zero Spread account. The commission fee is also calculated according to the currency pair.

Specifically, for AUDUSD – EURUSD – EURJPY – GBPJPY – GBPUSD – USDCAD – USDCHF – USDJPY pairs, HotForex charges $6/lot. For other pairs, HotForex charges $8/lot.

The commission fee also varies for other product codes. You need to look up the product you often trade on the HFM broker’s website.

- Swap fee (overnight fee):

- Swap là gì? Cách tính phí swap qua đêm như thế nào?

In addition to commission fees, overnight fees are also set up fairly complexly by the HFM exchange. You need to look up on the exchange’s official website to get a clearer understanding for the product you are trading. Overnight fees can be adjusted daily based on market conditions and the liquidity provider’s price, applied to open positions. Like most other exchanges, the overnight fee is tripled on Wednesdays.

Depositing and withdrawing money at the HFM exchange.

Opening an account with the HFM exchange.

- Identity verification.

- To deposit funds into the HFM trading platform, you need to go through the steps of opening an account and verifying your identity. Any forex trading platform will require you to complete account verification to prevent money laundering. Therefore, please complete account verification before depositing funds for trading.

- You will need to prepare two types of documents to verify your forex account:

- National ID card or passport

- Bank statement. The statement should be no more than 3 months old, and the address on the statement must match the address on your national ID card or passport.

- After uploading these two verification documents, the platform will quickly verify your information.

Minimum deposit amounts at HFM:

- Micro account: $5

- Premium and HFCopy account: $100

- Zero Spread and Auto account: $200

- PAMM account: $250

- Withdrawal and deposit processing times at HFM are dependent on the specific payment method chosen and may vary.

- The money you deposit will only be credited to myWallet. You need to perform an additional internal transfer from myWallet to your trading account.

- Deposits are processed 24/5 from 00:00 Monday to 00:00 Saturday (according to Server time).

- Deposits will be credited to your Wallet immediately.

- HFM accepts multiple currencies, including digital currencies (e-wallets) and cryptocurrencies. If you have Internet Banking, the process of depositing money from Online Bank Transfer will be quite simple.

- Note: It is not recommended to use Visa/Master card transactions. Some banks block this function, preventing you from depositing or withdrawing money.

HFM payment gateway.

- HFM exchange accepts payments in BTC, ETH, LTC, and USDT, but deposits through this channel are usually slower due to reliance on the blockchain network.

- However, for an average investor, it is recommended to use Internet Banking via two portals: Online Bank Transfer or Direct Online Banking, to deposit and withdraw funds on the HFM exchange due to the following reasons:

- No transaction fees, extremely fast deposit and withdrawal speeds. Maximum deposit limit up to 300 million VND, minimum 300,000 VND.

- Easy to use, similar to online shopping payments.

- Lowest exchange rate differences.

Training at HFM Exchange

- HFM provides a system with over 50 carefully designed training videos delivered by top industry experts Stuart and Andria. The videos provide analytical information on basic concepts of the forex industry to teach you everything you need to become a forex trader. The videos are divided into 6 categories including trading psychology, trading strategies, as well as basic forex knowledge.

- Webinars for training are regularly held on the main website of the exchange. However, currently, these programs do not support Vietnamese language.

- Trading hours for products on the HFM exchange

- The trading hours for forex products on the HFM exchange on the Metatrader platform are from 00:00:51 on Monday to 23:59:59 on Friday, according to the Server Time. Winter: GMT+2, Summer: GMT+3.

- A short time before opening, at this point, orders from the previous weekend may be executed. Quotes during this time are not intended to execute new orders. After the market opens, traders can place new orders, cancel or modify current orders.

- Note that during the first few hours after the market opens, trading volume tends to be thinner than usual until the Tokyo and London sessions start. Low trading volume may lead to wider spreads and increase the possibility of slippage.

Some trading experiences on the HFM exchange

HFM allows funding with coins but currently does not allow crypto trading. Therefore, if you intend to trade crypto, HotForex should not be chosen.

Limit trading in the early morning when the market has a significant spread range.

If you are an experienced and profitable trader, consider opening a managed account at PAMM or HFCopy. There is a large number of customers interested in copying trades at HFM. Managing funds through a PAMM or HFCopy account can be an attractive channel for earning passive income if trading is profitable.

If you intend to withdraw funds, please do so before 3 pm to receive the funds on the same day.

Customer Support

HFM is one of the forex brokers that takes great care of customer support. However, Vietnamese language support is currently not emphasized on the website.

You can use the Live Chat feature on the website or send an email to contact HFM. If you are not proficient in English, you can use Google Translate.

Your requests will be addressed 24/5, from Monday to Friday.

The support team at HFM responds very promptly via Live Chat, with a response time of around 30 seconds. Email responses may take longer, up to a few hours.

- Fast and Reliable Payments

- Unlimited trial

- Lowest spread offered with a very low commission

- Extremely well-regulated

- Good copy trading proprietary platform

- The broker may close your account after 30 days of inactivity

- EU clients have a different minimum deposit

- Services may differ depending on your area

- No social trading feature