- Low stock and stock index CFD fees and no inactivity fee

- Easy and fast account opening

- Excellent customer support & education

- Slim product portfolio

- Few account base currencies

- No investor protection for non-EU clients

Overview

-

Fast Deposits & Withdrawals:

Fbs

- Low stock and stock index CFD fees and no inactivity fee

- Easy and fast account opening

- Excellent customer support & education

- Slim product portfolio

- Few account base currencies

- No investor protection for non-EU clients

Overview of FBS trading platform

FBS is a well-established brokerage company with years of experience in the financial market. Besides being highly active in marketing activities, FBS provides numerous benefits to its clients such as low spreads, competitive commissions, accurate pricing up to 5 decimal places for all account types, and no requotes.

Moreover, FBS offers a diverse range of trading products including Forex, Indices, Stocks, and Precious Metals. The platform provides simple and fast deposit and withdrawal processes, attractive bonus programs, and leverage support up to 1:3000.

After more than 13 years of operation, FBS has made a strong impact on the Asian financial market. The company has built over 19 different websites for each country and attracts over 7,000 new trader accounts every day. FBS successfully retains more than 80% of its existing clients and up to 48% of its clients view profits from FBS as their main source of income.

| Founded in | 2009 |

| Management agency | IFSC |

Exchanges | STP & ECN |

| TMinimum deposit | 1$ |

| Spreads | Từ -1 pip |

| Trading platform | MT4, MT5, FBS Trader |

| Support language | English, Vietnamese |

| Deposit and withdrawal methods | Internet Banking, Visa/Master Card, Skrill, Neteller,.. |

FBS is an international brokerage firm established in 2009, headquartered at 2118 Guava Street, Belize Belama Phase 1, Belize. With a long history of formation and development, FBS has become a leading forex broker in the ranking of forex brokers that brings many benefits to customers worldwide.

- As of the current time, FBS has achieved many impressive figures such as:

- Present in more than 150 countries

- Own 23,000,000 traders

- More than 410,000 major partners choose FBS as their preferred forex company

- Customer profit reaches 500,000,000 USD per year

- Possessing many prestigious awards in the industry.

- Become a sponsor of many famous football clubs.

Is FBS reputable?

When choosing a forex broker, traders are concerned about the reliability and safety of the trading platform. To evaluate whether FBS is reputable, 8th Street Grille will rely on an objective evaluation process based on criteria such as operating licenses, customer protection policies, awards received, and other factors.

FBS License

FBS is regulated and licensed by the International Financial Services Commission (IFSC) with license number IFSC/000102/310. This agency is responsible for supervising FBS’s operations, ensuring compliance with legal frameworks around the world, and protecting the best interests of its clients.

Translation: FBS Awards

Since its establishment, FBS has received over 70 international awards. Among them, some notable achievements are:

2020:

- Best Forex Broker Asia

- Best Forex Broker LatAm

- Best Copy Trading Application

- Best Mobile Trading Platform

- Best Forex Broker

2019:

- Most Progressive Forex Broker Europe

- Best Forex Broker Europe

- Best Forex Broker Vietnam

- Best Forex Broker Middle East

- Best Copy Trading Platform

- Best Trading Service in Vietnam

- Best Broker in Malaysia

2018

- Most Transparent Forex Broker – 2018

- Best Forex Trading Account 2018

- Best Copy Trading Application Global 2018

- Best Forex Broker Asia 2018

- Best Investor Education 2017

- Best FX IB Program – China 2017.

- Client funds are completely separate from the exchange’s funds. When the customer makes a transaction, the money will be transferred directly to the bank holding the money, FBS cannot use the customer’s assets for any purpose. Client funds are always safe even if FBS goes bankrupt.

- FBS joins CIF Investor Compensation Fund. This is a fund for clients of Cypriot investment companies. For the purpose of ensuring the interests of customers when there are complaint situations or when the exchange does not properly follow its process for this fund, investors can be compensated up to 20,000 EUR.

Trading products at FBS

Currently, FBS exchange is offering a diverse range of trading products that fully meet the needs of today’s investors and are categorized into the following 7 asset groups:

- Forex: Trade with 27 currency pairs, including 7 major currency pairs and 20 minor currency pairs.

- Metals: Trading with precious metals such as gold, silver…

- Indices: Provides 11 popular indexes in the world including: AU200, DE30, ES35, EU50….

- Energy: There are 3 main types: Brent Crude Oil, Gas, WTI Crude Oil

- Forex Exotic: 8 large liquid exotic currency pairs

- Stocks: More than 100 types of stocks from big companies like Microsoft, Amazon, Coca cola, pepsi, Facebook, nike, etc.

- Cryptocurrencies: Provides 30 of the most popular cryptocurrencies today.

Trading Platform of FBS

In order to provide customers with the best trading experience, FBS offers 3 modern trading platforms including MT4, MT5, FBS Trader, and a Copy Trade platform. Let’s learn more about these platforms below!

MT4 software

FBS provides the MetaTrader 4 (MT4) platform for Windows and Mac computers, as well as the Android and iOS mobile platforms. This is a popular trading software that allows you to participate in trading anytime, anywhere with many outstanding features, such as:

- Encrypt data exchanged between the client terminal and the platform on the server

- Support the ability to create, buy and use expert advisors (EAs) in the best way

- Professional technical analysis tools: with 50 indicators and charting tools

- Catch news and trade easily in just one click

- Support 4 types of pending orders, VPS service and hedging for transactions

MT5 software

Software MT5 (MetaTrader 5) was created to address the limitations of the MT4 platform. It provides customers with more flexible options in terms of analysis tools, the ability to trade stocks, commodities, currency pairs, and various trading timeframes.

Features of MT5 software provided by FBS include:

- Tính năng tùy chọn mở rộng, nhằm tạo ra các chỉ báo kỹ thuật, robot giao dịch và ứng dụng tiện ích.

- Hỗ trợ công cụ phân tích kỹ thuật gồm: 90 chỉ báo và các công cụ biểu đồ

- Nắm bắt tin tức và giao dịch nhanh chóng chỉ trong một cú nhấp chuột

- Hỗ trợ 6 loại lệnh chờ, 21 khung thời gian, dịch vụ VPS, lịch kinh tế.

- Hỗ trợ chiến lược phòng ngừa rủi ro (Hedging) cho các giao dịch.

FBS Trader

This is an exclusive software developed by FBS Exchange specifically for its customers. FBS Trader uses a completely free platform and can be downloaded to a computer or phone for a better user experience.

The outstanding features of FBS Trader include:

- Easily trade Forex, stocks, metals, energies, indices and cryptocurrencies.

- Intuitive charts and various analysis tools

- Easy financial management

- Cashback and Quick Start Bonus $100

Copy Trade Platform

Translated to English: Copy Trade is a social trading platform of the FBS exchange. This platform is quite suitable for new traders who do not have much trading experience. With just a few simple steps, traders can easily copy trades from professional traders and generate income for themselves.

However, currently on the FBS website, there is an announcement that “FBS CopyTrade will stop operating on September 22”. Therefore, traders need to take note of this information or find another copy trading platform from another exchange to execute trades.

Types of FBS Accounts

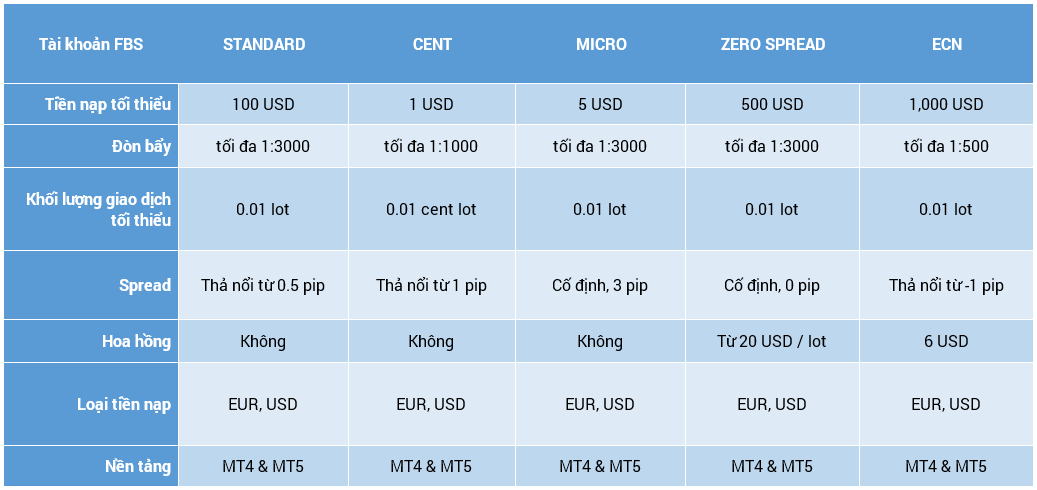

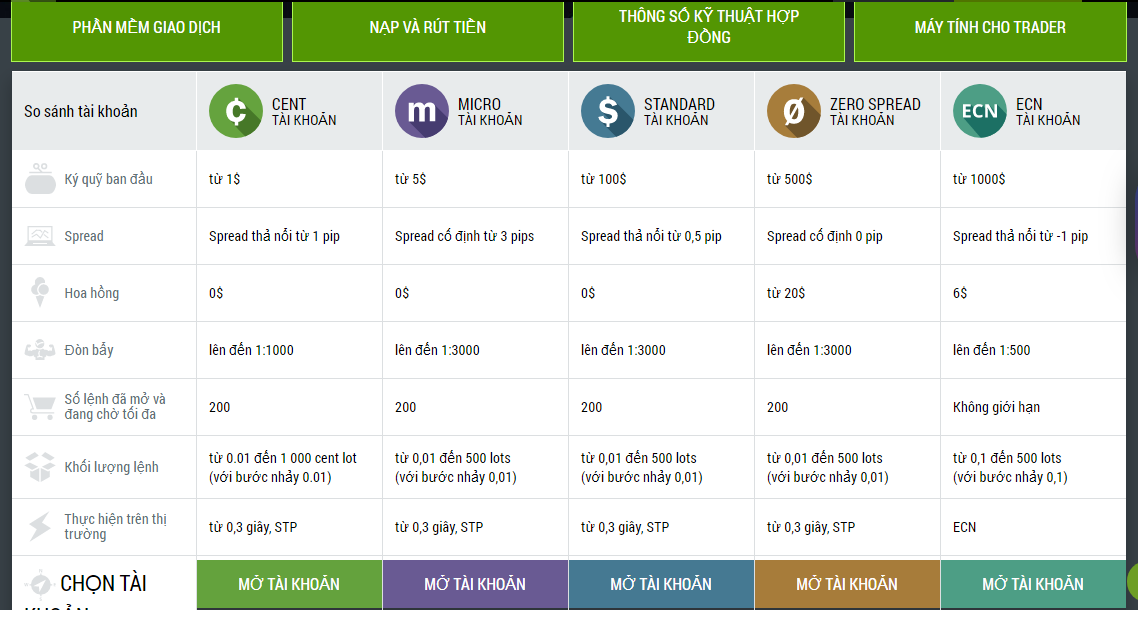

Currently, FBS is providing six types of trading accounts for customers to choose from according to their preferences, including Standard account, Cent account, Micro account, ECN account, Zero Spread account, and Crypto account. Each type has its own characteristics and is suitable for different types of traders as follows:

Cent account

Trading conditions of Cent account:

- Initial deposit: 1 USD

- Spread: floating spread from 1 Pip

- Commission: 0 USD

- Leverage: 1:1000

- Maximum number of open positions and pending orders: 200

- Order Size: Minimum from 0.01 to 1,000 Cent Lot (in 0.01 increments)

- Market order execution: From 0.3 seconds, STP

Cent account is suitable for novice traders with limited experience, traders who want to trade with small volumes, those with limited investment capital, or traders who want to test new strategies.

Micro account

Trading conditions of Micro account:

- Initial deposit: 5 USD

- Spread: fixed from 3 pips

- Commission: 0 USD

- Leverage: up to 1:3000

- Maximum number of open positions and pending orders: 200

- Order volume: from 0.01 to 500 lots (the jump is 0.01)

- Market order execution: from 0.3 seconds, STP

For just a $5 deposit, you can successfully open a Micro account. This type of account has the advantage of having no commission fees, but it has a fixed spread of 3 pips which is considered quite high. The Micro account is suitable for traders who want to know the details of their profits, as this type of account provides a profit calculator tool.

Standard account

Standard account trading conditions:

- Initial deposit:100 USD

- Spread: floating from 0.5 pips

- Commission: 0 USD

- Leverage: up to 1:3000

- Maximum number of open positions and pending orders: 200

- Order volume: from 0.01 to 500 lots (the jump is 0.01)

- Market order execution: from 0.3 seconds, STP

The Standard account with an extremely competitive spread and no commission, leverage of 1:3000, is ideal for traders seeking a traditional trading experience.

Zero Spread account

Zero Spread account trading conditions:

- Initial deposit: 500 USD

- Spread: fixed 0 pips

- Commission: receive from 20 USD/lot

- Leverage: 1:3000

- Maximum number of open positions and pending orders: 200

- Minimum order size from 0.01 to 500 lots (the jump is 0.01)

- Market order execution: from 0.3 seconds, STP

The Zero Spread account is well-liked by traders because it has no spread. However, this account type has a high minimum deposit of 500 USD and a commission of 20 USD per lot, which are considered quite high and not suitable for inexperienced traders. You should only use this account when you have been in the market for a long time and have real trading experience.

ECN account

Trading conditions of ECN account:

- Initial deposit: 1,000 USD

- Spread: floating from -1 pip

- Commission: 6 USD

- Leverage: up to 1:500

- Maximum number of open positions and pending orders: unlimited

- Order size: from 0.1 to 500 lots (jump 0.1)

- Market order execution: ECN

The ECN account is suitable for experienced traders. This type of account has a high initial deposit of 1,000 USD and a commission of 6 USD. However, this account also provides many benefits to customers such as the fastest market order execution, low spreads from -1 pip, large liquidity providers, and optimal quotes without delay.

Crypto Accounts

Crypto account trading conditions:

- Initial deposit: 1 USD

- Spread: floating spread from 1 pip

- Commission 0.05% for open positions, 0.05% for closed positions

- Lever: 1:5

- Maximum number of open positions and pending orders: 200

- Order volume: 0.01 to 500 lots (0.01% jump)

- Market order execution: from 0.3 seconds, STP

The Crypto account supports a wide range of trading pairs, such as coins, coin-coin, coin-fiat, and coin-metals. This is an ideal choice for traders who enjoy trading cryptocurrencies.

Comparison table between accounts

| Compare accounts | Standard | Cent | Micro | Zero Spread | ECN | Crypto |

| Initial deposit | 100$ | 1$ | 5$ | 500$ | 1.000$ | 1$ |

| Spread | From 0.5 pips | From 1 pip | Fixed 3 pips | 0 pip | From 1 pip | 1 pip |

| Minimum lot volume | 0.01 – 500 lots | 0.01 – 1.000 cent lot | 0.01 – 500 lots | 0.01 – 500 lots | 0.1 – 500 lot | 0.01 – 500 lot |

| Lever | 1:3000 | 1:1000 | 1:3000 | 1:3000 | 1:500 | 1:5 |

| Maximum number of open positions and pending orders | 200 | 200 | 200 | 200 | Unlimited | 200 |

| Rose | 0$ | 0$ | 0$ | 20$/ lot | 6$ | 0.05% for closed positions – open |

| Market order matching | From 0.3 seconds, STP | From 0.3 seconds, STP | From 0.3 seconds, STP | From 0.3 seconds, STP | ECN | From 0.3 seconds, STP |

FBS exchange fee

The transaction cost is always a top concern for traders when choosing a trading platform, as these fees will directly affect the profit that the trader earns after each trade. Here are the fees on the FBS trading platform:

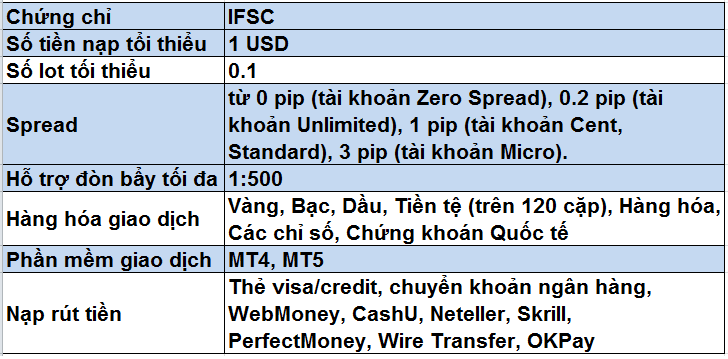

FBS spread

The current Spread offered by FBS trading platform exists in two forms: floating and fixed. The level of Spread varies for each type of account. Specifically:

- Tài khoản Standard: Spread thả nổi từ 0,5 pip

- Tài khoản Zero Spread: cố định từ 0 pip

- Tài khoản Micro: Spread cố định từ 3 pip

- Tài khoản Cent: Spread thả nổi từ 1 pip

- Tài khoản ECN: Spread thả nổi từ -1 pip

- Tài khoản Crypto: Spread thả nổi từ 1 pip

FBS exchange overnight fee

Overnight fee on the FBS platform, also known as Swap fee, is only charged if you hold a position overnight. The amount of the fee, whether it’s positive or negative, depends on the trading volume and the interest rate of the currency pair that the investor is trading.

This is a fee that exists on any Forex platform, and FBS is no exception. At FBS, the overnight fee is calculated between 23:59:00 and 00:00:00 every day, except for weekends. FBS will triple the overnight fee on Wednesdays.

For Muslim countries, there is no overnight fee charged. However, this option is not available for rare currencies, indices, energy, and cryptocurrencies.

FBS commission fee

FBS has up to 6 different account types for customers to freely choose and experience. In which 4 accounts including: Cent, Micro, Standard, Crypto are commission-free, only 2 ECN and Zero Spread accounts will be charged commission.

- Zero Spread account has a commission fee of 20 USD/Lot, which is quite high compared to other forex brokers in the market.

- The ECN account has a commission of 6 USD/lot, which is quite an attractive fee compared to many Forex brokers on the market today.

In terms of low spread and the best commission fees, an ECN account is the most suitable and appropriate choice.

FBS Leverage

The FBS trading platform provides leverage ratios ranging from 1:1 to 1:3000. While Exness offers unlimited leverage, FBS ranks second only to Exness in terms of leverage options. However, the maximum leverage for each account type on the FBS platform may vary. Here are the details:

- Standard, Micro, Zero Spread Account: 1:3000

- Cent account: 1:1000

- ECN account: 1:500

- Crypto Account: 1:5

In this way, the leverage level is the same for the Standard, Micro, and Zero Spread accounts, while for other accounts, the maximum allowable leverage level will be lower. In order to use leverage on the FBS trading platform, traders will have to comply with the margin requirements set by the platform.

- Standard, to enjoy 1:3000 leverage, the initial deposit is 100 USD.

- Micro initial deposit amount is 5 USD.

- Zero Spread initial deposit amount is 500 USD.

- Cent, customer must deposit the initial amount of 1 USD

- ECN, initial deposit amount is 1,000 USD

- Initial Deposit Crypto 1 USD

Leverage on the FBS trading platform is quite diverse and highly attractive. However, the higher the leverage ratio, the greater the risk of potential losses. Therefore, investors need to calculate and manage their available financial resources on the platform to avoid account depletion and unwanted risks.

Deposit and Withdrawal on FBS Trading Platform

FBS supports customers through various payment gateways such as:

- Bank Transfer:

- Visa/Mastercard

- Ewallet: Perfect Money, Stick Pay, Skrill, Neteller.

Deposit and withdrawal time

- The processing time for margin orders at FBS is fast. Accordingly, top-up transactions via Visa card, e-wallet will be processed immediately, and transactions via bank transfer will be processed in 15-20 minutes (maximum 48 hours).

- Withdrawal via e-wallet takes up to 48 hours, via visa card, bank transfer, it can take up to 5-7 days.

Deposit and withdrawal fees at FBS

When depositing money into an FBS account, there are no fees incurred. However, when using the Perfect Money e-wallet, investors may be charged by the payment system, and Stick Pay will incur a commission of 2.5% + $0.3.

When making a withdrawal transaction, a small fee must be paid accordingly:

- Withdrawal via Internet banking: 2% for each transaction

- Withdrawal via Visa/Mastercard: 1 USD – 1EUR/withdraw

- Withdrawal via Neteller: 2% + commission (minimum commission is 1 USD, and maximum is 30 USD)

- Withdraw via Skrill: cost 1% + commission is 0.32%.

- Perfect Money: 0.5% commission

The minimum deposit amount for FBS depends on the type of trading account that you choose. For example, the Cent account requires a minimum initial deposit of $1, while the ECN account requires a minimum initial deposit of $1000.

Conclusion about FBS

The above article has fully summarized the information about the FBS trading platform and provided objective evaluations to give investors an overview of FBS. Overall, with what 8th Street Grille has shared, investors can be assured when trading on FBS.

Advantage

- Wide range of trading products, including cryptocurrencies

- Offers multiple accounts, suitable for all traders.

- Supports the highest maximum leverage 1:3000

- There are many attractive promotions

- Professional, dedicated customer service.

- The steps to register an account on the FBS exchange are quite simple.